The following post discusses the Paul plans for taxes, spending and Social Security. These are some of his less known positions and it is important we get a full understanding of the man who could be the Republican Candidate for President.

Some of his ideas are close to those expressed by Herman Cain (cutting spending) and Perry (elimination of departments) but Paul puts them all together. What is your opinion? We want to hear from you.

Conservative Tom

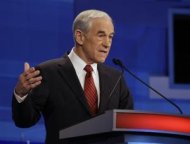

Paulonomics: Ron Paul’s plans for taxes, spending and Social Security

By Zachary Roth | The Ticket – 56 mins ago

AP Photo/Eric Gay, Pool

Here are they key components of Paul's economic plan, "Restore America," released in October:

Spending: Paul proposes cutting $1 trillion from the federal budget during his first year in office, and balancing the budget by his third year. He would do this in part by eliminating five cabinet departments: Energy; Housing and Urban Development; Commerce; Interior; and Education. (Paul has not offered specifics on what would happen to some of the functions currently performed by the departments he wants to abolish--maintaining our nuclear weapons, administering our intellectual property system, and conducting the Census, for instance.)

He would also scrap the Transportation Security Administration, which is part of the Department of Homeland Security, eliminate corporate subsidies, end foreign aid, and return most other federal spending to 2006 levels.

Paul says he would cut the federal workforce by 10 percent, and accept a presidential salary of $39,336- roughly equal to what the average American makes. The president currently makes $400,000.

Paul, who opposes almost all American military intervention overseas, also says he would save money by ending foreign wars.

Taxes: Paul has said in the past that he'd like to abolish personal income tax rates, but his plan doesn't suggest that. It does propose lowering the corporate tax rate to 15 percent, from 35 percent. And it would extend the Bush tax cuts and eliminate the estate tax. Paul's campaign has said elsewhere that he supports eliminating the capital gains tax, which, as we've written, would be a boon for, among others, private-equity managers on Wall Street.

Regulation: Like most of his rivals, Paul would repeal President Obama's health care law. He would also get rid of the Dodd-Frank financial reform law intended to increase regulation of Wall Street. And he'd scrap Sarbanes-Oxley, the corporate governance law passed in the wake of the Enron scandal.

Monetary Policy: Paul has written a book called "End the Fed," but his plan calls only for auditing the central bank--something he's been trying to do as a legislator. He also would push "competing currency legislation"--meaning he wants individuals to be able to use alternative currencies to the dollar, including gold and silver. The idea is to reduce the federal government's control over the monetary supply.

Social Security, Medicare, and Medicaid: Paul says he wouldn't scrap Social Security and Medicare. His plan "honors our promise to our seniors and veterans," meaning that those currently in the programs could stay in them. But he would like to allow younger workers to opt out of the Social Security system and the payroll taxes it imposes--although the details of how he would accomplish this are unclear.

"Dr. Paul is committed to fully funding Social Security and Medicare while we work a transition to allow young workers the freedom to save for their own retirement," Jesse Benton, the national chairman of Paul's presidential campaign, told Yahoo News.

Benton implied that the Social Security and Medicare payments for current retirees--paid for by payroll taxes on younger workers under the current system--would be provided by radically reducing the American military footprint around the globe, along with other cuts. "It will require cuts elsewhere, but we can save hundreds of billions of dollars a year by bringing troops home, ending foreign welfare and overseas nation building and providing a stronger national defense here at home," Benton said. "If we cut and work hard, we can take care of our seniors who rely on their Medicare and Social Security."

In its basic outline, Paul's plan shares several common features with those of his Republican rivals. All support extending the Bush tax cuts, and most want to lower the corporate tax rate. Newt Gingrich, Jon Hunstman, and Rick Perry would scrap the capital gains tax. And a desire to cut government spending is almost a requirement for entry into the Republican field.

If Paul's profile in the race continues to rise, he'll likely be required to fill in some of the plan's details, which remain vague. Extending the Bush tax cuts and cutting the corporate tax rate by more than half would make it difficult to balance the budget in three years, even by eliminating five Cabinet departments and cutting waste. The only feasible way to do so would be large cuts to the three big drivers of government spending: Social Security, Medicare, and the military.

I think you are way off basis in your description of Ron Paul. You make it seem like he is getting his ideas from Cain and Perry when it is pretty much the other way around. Perry himself credited Ron Paul for opening his eyes to the role the Fed plays in cause economic turmoil. Ron Paul was the only person talking about the Fed in 2008 election. Now we even have "big government Gingrich" talking about auditing the Fed. Ron Paul's ideas on the Fed and the gold standard are simple: the Fed allows government to spend beyond its means and get itself into the predicament we have today. Ron Paul follows the Austrian economic school whose two big names are Ludwig Von Mises and Friedrich Hayek. Mises was Hayek’s teacher and Hayek won the Nobel Prize in economic for elaborating Mises ideas on the business cycle. This ties in closely with the monetary system and the Fed so you see that Ron Paul has a solid foundation behind what he is saying. Mises himself saw nothing special about Gold backed money except for one thing: it constrained Government to live within its means. With a fiat money system the Government can print money (through the fed) and run deficits.

ReplyDeleteYou see my dear friends there is a substantial amount of knowledge, economic theory and historical perspective behind Ron Paul’s position. Most people are ignorant of this and sometimes his rants on the Fed and non-interventionist foreign policy (which is the true conservatives position) come across mangled and make it seem as if he is a crackpot. The establishment (both right and left)have more articulate but less well informed and less wise people which are out there belittling and trying to marginalize Ron Paul and his positions. Hopefully his run will help spread the word and people can begin educating themselves about issues such as Austrian economic and “Classical liberalism” which is what laissez-faire economic is all about. Some good source on this are “mises.org” and “FEE.org”