Elizabeth Warren wants to use her wealth tax to wipe out Americans’ college debt and pay for tuition

KEY POINTS

- Democratic presidential candidate Elizabeth Warren has identified something else to finance with her proposed wealth tax: wiping out student debt and tuition at public colleges.

- She says her proposal would benefit 95% of the 45 million Americans carrying student debt and wipe it out for 75% of them.

- Warren’s plan would also cut off federal money from for-profit colleges, which she says “enrich themselves while targeting lower-income students, service members and students of color and leaving them saddled with debt.”

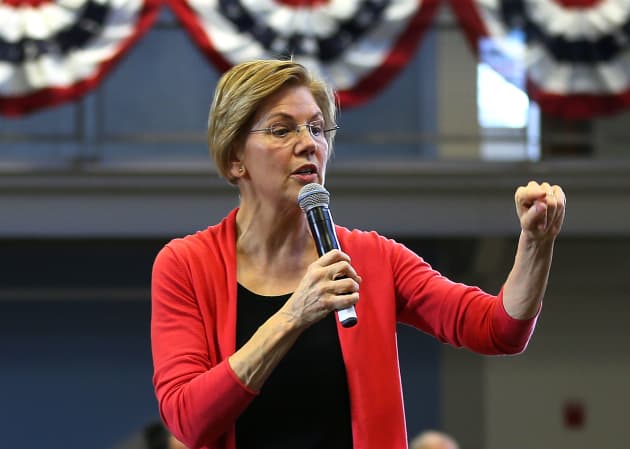

U.S. Senator Elizabeth Warren speaks at Manchester Community College in Manchester, NH on Jan. 12, 2019.

John Tlumacki | Boston Globe | Getty Images

Democratic presidential candidate Elizabeth Warren has identified something else to finance with her proposed wealth tax: wiping out student debt and tuition at public colleges.

The Massachusetts senator, who has raced ahead of her 2020 rivals with detailed plans to rearrange America’s economic priorities, unveiled on Monday her proposal for easing access to higher education. It would:

- Spend $1.25 trillion over 10 years to eliminate up to $50,000 in student debt for those with household incomes under $100,000

- Allow states to make public colleges tuition-free

- Spend $100 billion on expanded Pell grants to defray more nontuition expenses

The money would come from the 2% annual tax she proposes to levy on accumulations of wealth exceeding $50 million, with an additional 1% on wealth exceeding $1 billion. Warren justified the link by asserting that higher education financing has long been crimped by tax cuts for wealthy Americans and corporations.

“It’s time to end that experiment, to clean up the mess it’s caused and to do better,” Warren wrote in a Medium post. “We can make big structural change and create new opportunities for all Americans.”

Warren’s plan would scale back relief for people with incomes above $100,000 and would end entirely at the $250,000 level. She said her proposal would benefit 95% of the 45 million Americans carrying student debt and wipe it out for 75% of them. Those steps, she argued, that would stimulate the economy by improving credit scores, increasing homebuying and easing small-business formation.

At the same time, it would cut off federal money from for-profit colleges, which she says “enrich themselves while targeting lower-income students, service members and students of color and leaving them saddled with debt.”

Warren’s wealth tax would raise an estimated $2.7 trillion over 10 years. She has previously proposed using roughly $700 billion of that money to provide universal child care and early childhood education. In theory, that would leave nearly $1 trillion more for Warren to spend.

WATCH NOW

Warren has separately proposed a “Real Corporate Tax” designed to raise more than $1 trillion over 10 years from companies with profits exceeding $100 million, which now use deductions and loopholes to minimize or even eliminate their federal tax liabilities. She has also outlined higher estate taxes intended to raise $400 billion for expanding access to affordable housing.

With her flurry of proposals, Warren aims to demonstrate how fundamental policy shifts can expand opportunity for average Americans, curb the trend toward widening income inequalityand boost the overall economy in the process. In the crowded field of Democratic contenders, she seeks to stand out with the expertise gained in a career of consumer advocacy.

So far, the second-term senator has lagged behind rivals such as Sen. Bernie Sanders, former Rep. Beto O’Rourke and Sen. Kamala Harris in fundraising and in national polls. Even in New Hampshire, next door to Massachusetts, polling averages show her far behind Sanders and former Vice President Joe Biden, who is expected to enter the race this week.

One challenge facing Warren, among others in the massive 2020 field, is expanding her support among non-white voters who represent a large of growing chunk of the Democratic electorate. With so many blacks and Latinos burdened with student debt, Warren touted her plan’s ability to narrow the wealth gap between whites and those two groups. It includes a $50 billion fund to assist historically black colleges and universities.

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.