Why Your Savings And Retirement Will Soon Be Gone

THINKSTOCK

What’s left of the U.S. middle class is under economic assault like no time in American history.

Federal Reserve money printing is finally catching up to us. One hundred years of money printing is coming to a head. We are seeing the beginning phases of hyperinflation.

Never mind the Bureau of Labor Statistics’ phony inflationary measurement, where the consumer price index basket of goods is changed monthly to remove price-rising goods. Food prices are up 19 percent just since January. On an annualized basis, that is 76 percent. Rising food prices and rising gas prices are where the middle class see and feel inflation.

Remember that inflation is not rising prices. Rising prices are a symptom of inflation, which is an increase in the money supply through money creation or debt.

Printing money is a crime if you do it. But if the powerful government monopoly does it, it’s called “monetization.” Government is now desperately inflating because the more inflation, the more wealth is stolen.

Here are some truths:

- Governments steal as much as they can without collapsing the system (they hope).

- The more money they create for nothing, the richer and more powerful they get.

- The bigger the government gets and the more reckless it gets, the more it must suppress its people, because many begin to wake up.

- The bigger government crime, the greater the propaganda and deception.

- Fact: Every dollar the government creates means that a dollar is stolen from the people. Paper money confiscates wealth.

The act of money creation means that more and more of the national wealth flows to the Federal government. How in the name of Pete do people think that the U.S. government became so powerful and so wealthy in property?

The government produces nothing. It has to steal, and it does so on an unimaginable scale. The mind of man cannot deal with such a massive transfer of wealth, and few people even suspect it. Why do people not know about the biggest fraud in history?

In addition to $75 billion a month of quantitative easing, the Federal government is running multi-hundred-billion-dollar deficits. The U.S. now has at least $126 trillion in outstanding obligations (i.e., money it has stolen from the American people).

So what’s a government to do? Steal even more from the people.

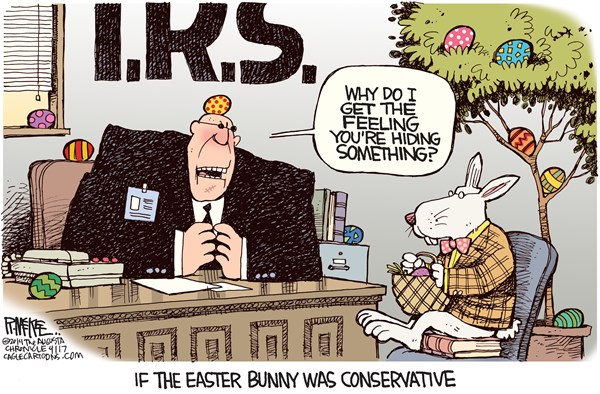

The Federal government is eyeing the remaining savings and retirement accounts of the American people. This has been going on for years. In fact, individual retirement accounts were set up to fool Americans into investing in the stock market to prop it up, help consolidate retirement accounts and transfer it to the bankster mob. Think your money in IRAs, 401(k)s and pension funds belong to you? Ha! Try to take out your money and see what hoops you have to jump through and what penalties you have to pay.

There is now more than $21 trillion in U.S IRAs, 401(k)s and pension plans. That $21 trillion would more than offset the mythical $17.5 trillion U.S. “debt.” For more on the U.S. debt, readThe ‘National Debt’ Is Smoke And Mirrors.

Last year, the U.S. Consumer Protection Bureau, established by the 2010 Dodd-Frank Act, stated that it believes Americans are too stupid to prepare on their own for retirement and that it has proposed “managing” people’s retirement funds. What that means is another unConstitutional government agency will take your money and swap it for government funny money.

President Barack Obama’s MyRA “savings plan” is yet another scam to try and prop up the failing system. Announced at this year’s State of the Union address, Obama tried to huckster this boondoggle as a great way to “invest” in safe government securities and a starter savings account.

The term “government securities” is nothing more than typical government double-speak and an oxymoron. When the government goes bankrupt — and it will — those Treasuries will be worthless. And now the government is encouraging you to buy them.

MyRAs will earn the same interest as the Thrift Savings Plan (TSP) Government Securities Investment Fund that is available to Federal employees. The TSP’s own paperwork says this about its interest rate: “The G Fund is subject to inflation risk, or the possibility that your G Fund investment will not grow enough to offset the reduction in purchasing power that results from inflation.”

If you want to “invest” in the U.S. government (not something I would recommend), there is currently a provision to do so. The MyRA plan mimics it. Just open an account with Treasuryto buy U.S. savings bonds. The difference is that MyRA will be run by a crony Wall Street firm.

All your savings will be visible to government and available for confiscation — the same government that is already eyeing your pension funds, individual retirement accounts and 401(k) plans, as I mentioned. Don’t think this will happen? Governments across the globehave already done so, and the U.S. government is on board in supporting what it is speciously calling “bail-ins” as occurred in Cyprus.

Under the scheme, when banks get in trouble or government needs more money, it swaps your bank savings for bank stock. You are in essence “buying” into the bank.

And if this news isn’t bad enough, take these two factors into consideration. Last fall, the International Monetary Fund issued a report recommending a series of escalating income and consumption tax increases, culminating in the direct confiscation of assets. Then last week, Russia floated a balloon through its Voice of Russia propaganda arm that it intends to attack the petrodollar in retaliation for America’s meddling in Ukraine.

First, from the IMF, according to page 49 of its report:

The sharp deterioration of the public finances in many countries has revived interest in a “capital levy”— a one-off tax on private wealth—as an exceptional measure to restore debt sustainability. The appeal is that such a tax, if it is implemented before avoidance is possible and there is a belief that it will never be repeated, does not distort behavior (and may be seen by some as fair). … The conditions for success are strong, but also need to be weighed against the risks of the alternatives, which include repudiating public debt or inflating it away…The tax rates needed to bring down public debt to precrisis levels, moreover, are sizable: reducing debt ratios to end-2007 levels would require (for a sample of 15 euro area countries) a tax rate of about 10 percent on households with positive net wealth.

Regarding Russia and the petrodollar, this is not the first time another nation has threatened to trade oil outside the dollar. Such a move would be disastrous for the American economy and likely crash it.

Because of an agreement between the U.S. and Saudi Arabia, in order to trade in oil, countries must first transfer their money into U.S. dollars. This happens no matter who is buying the oil or who they’re buying it from. The oil-buying country gives the oil-selling country U.S. dollars and receives oil in exchange.

The oil-selling country then has to sell those dollars to convert it back to its own currency. If Russia, China and a few other countries begin trading oil in some other currency, about 3 trillion U.S. dollars will suddenly flood the market. This will send hyperinflation into the stratosphere.

I have long sounded a warning to get your retirement funds out of the system and remove your money from banks (beyond what is necessary to pay bills) in order to protect yourself. I did so long ago. I gladly took the penalty and have long since recovered what was taken.

I also recommend you buy gold and silver and keep it in your possession, not in the bank or in a safe deposit box.