Presidential candidate Bernie Sanders has been a loud critic of the ultra wealthy. Under his newest plan, he is ensuring those in the highest income bracket pay what he sees as their fair share in taxes.

On Tuesday, Sanders released his “Tax on Extreme Wealth” proposal. The plan would place a 1% tax on the top 0.1% of American households. That translates to those who have a net worth above $32 million, who would pay a wealth tax of $5,000.

“At a time when millions of people are working 2 or 3 jobs to feed their families, the three wealthiest people in this country own more wealth than the bottom half of the American people,” Sanders said. “Enough is enough. We are going to take on the billionaire class, substantially reduce wealth inequality in America, and stop our democracy from turning into a corrupt oligarchy.”

The tax rate would increase depending on net worth — there would be a 2% tax on those worth between $50-250 million, 3% tax on those worth between $250-500 million, 4% for those between $500 million to $1 billion, 5% from $1-2.5 billion, 6% from $2.5-5 billion, 7% from $5 to $10 billion, and 8% tax on wealth over $10 billion. According to the plan, “these brackets are halved for singles.”

Sanders claims that “the wealth of billionaires would be cut in half over 15 years which would substantially break up the concentration of wealth and power of this small privileged class.”

The revenue generated from this tax on the wealthy would go towards other plans of Sanders, including Medicare for All, universal child care, and affordable housing.

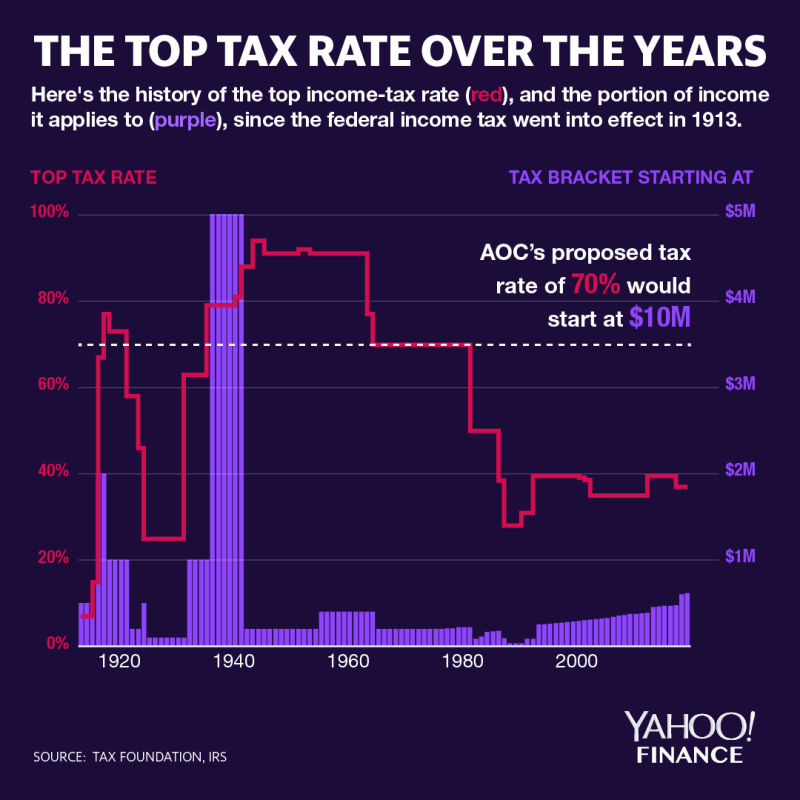

There is growing support for taxing the wealthy. A poll from Politico/Morning Consult found that 76% of registered voters think wealthy Americans should pay more taxes. And, a Fox News survey found that 70% of Americans, including 54% of Americans, are in support of raising taxes on those who earn more than $10 million.

University of California, Berkeley economists Gabriel Zucman and Emmanuel Saez, who have written extensively about the effects of wealth taxes, analyzed the Sanders proposal and estimates that this would raise $4.35 trillion over the next decade.

Zucman and Saez’s $4.35 trillion estimate is higher than the two projected for Sen. Elizabeth Warren’s wealth tax plan released earlier this year. Under her tax proposal, there would be a 2% wealth tax on individuals with a net worth over $50 million and 3% tax on those over $1 billion.

“A progressive wealth tax is the most direct policy tool to curb the growing concentration of wealth in the United States,” the two said in a joint letter. “It can also restore tax progressivity at the very top of the wealth distribution and raise sorely needed tax revenue to fund the public good. Senator Sanders’ very progressive wealth tax on the top 0.1% wealthiest Americans is a crucial step in this direction.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

Federal Income Tax Brackets (Tax Year 1914)

Federal Income Tax Brackets (Tax Year 1914)