The Warren Buffett Economy——Why Its Days Are Numbered (Part 4)

by David Stockman •

As documented in Parts 1-3 (Part 1, Part 2, Part 3), the Fed has generated a $50 trillion financial bubble since Alan Greenspan took the helm in August 1987. After 27 years, honest price discovery has been destroyed, thereby reducing the nerve centers of capitalism—-the money and capital markets—-to little more than gambling casinos.

Accordingly, speculative rent-seeking in the financial arena has replaced enterprenurial innovation and supply side investment and productivity as the modus operandi of the US economy. This has resulted in a severe diminution of main street growth and a massive redistribution of windfall wealth to the tiny share of households which own most of the financial assets. Warren Buffett’s $73 billion net worth is the poster boy for this untoward state of affairs.

The massive and systematic falsification of asset prices which lies at the heart of this deformation of capitalism is a direct and unavoidable consequence of monetary central planning. That is, the pursuit of Keynesian business cycle management and stimulus through central bank interest rate pegging and massive monetization of existing public debt and other securities—-especially since the latter has no purpose other than to artificially goose the price of bonds and lower their yields; and also via other indirect methods of financial asset levitation such as the Greenspan/Bernanke/Yellen doctrine of wealth effects and the implicit central bank “put” which underpins the economics of buy-the-dip speculators.

As previously indicated, the Keynesian bathtub model of a closed, volumetrically driven economy is a throwback to specious theories about the inherent business cycle instabilities of market capitalism that originated during the Great Depression. These theories were wrong then, but utterly irrelevant in today’s globally open and technologically dynamic post-industrial economy.

As reviewed in Part 3, the very idea that 12 people sitting on the FOMC can adroitly manipulate an economic ether called “aggregate demand” by means of falsifying market interest rates is a bad joke when in it comes to that part of “potential GDP” comprised of goods production capacity. In today’s world of open trade and massive excess industrial capacity, the Fed can do exactly nothing to cause the domestic steel industry’s capacity utilization rate to be 90% or 65%.

It all depends upon the marginal cost of labor, capital and materials in the vastly oversized global steel market. Indeed, the only thing that the denizens of the monetary politburo can do about capacity utilization in any domestic industry is to re-read Keynes’s 1930 essay in favor of homespun goods and weep!

As I detailed in the Great Deformation, the Great Thinker actually came out for stringent protectionism and economic autarky six years before he published the General Theory and for good and logical reasons that his contemporary followers choose to completely ignore. Namely, protectionism and autarky are an absolutely necessary correlate to state management of the business cycle and related efforts to improve upon the unguided results generated by business, labor and investors on the free market. Indeed, Keynes took special care to make sure that his works were always translated into German, and averred that Nazi Germany was the ideal test bed for his economic remedies.

Eighty years on from Keynes’ incomprehensible ode to statist economics and thorough-going protectionism, the idea of state management of the business cycle in one country is even more preposterous. Potential labor supply is a function of the global labor cost curve and now comes in atomized form as hours, gigs, and temp agency contractual bits, not census bureau headcounts.

In fact, the Census Bureau survey takers and the BLS numbers crunchers have not the foggiest idea as to what the real world’s potential labor force computes to, and how much of it is deployed on any given day, month or quarter. Accordingly, printing money and pegging interest rates in pursuit of “full employment”, which is the essence of the Yellen version of monetary central planning, is completely nonsensical.

Likewise, the Fed’s current “soft” target of 5.2% on the U-3 unemployment rate is downright ridiculous. When in the year 2015 you have 93 million adults not in the labor force—-of which only half are retired and receiving social security benefits(OASI)—-and a U-3 computational method that counts as “employed” anyone who works only a few hour per week—-then what you have in the resulting fraction is noise, pure and simple. The U-3 unemployment rate as a proxy for full employment does not even make it as primitive grade school economics.

At the present time, there are 210 million adult Americans between the ages of 16 and 68—to take a plausible measure of the potential work force. That amounts to 420 billion potential labor hours, if we accept the convention that all adults are at least theoretically capable of holding a full-time job (2,000 hours/year) and pulling their share of society’s need for production and work effort.

By contrast, during 2014 only 240 billion hours were actually supplied to the US economy, according to the BLS estimates. Technically, therefore, there were 180 billion unemployed labor hours, meaning that the real unemployment rate was 42.9%, not 5.5%!

Yes, we have to allow for non-working wives, students, the disabled, early retirees and coupon clippers. We also have drifters, grifters, welfare cheats, bums and people between jobs, enrolled in training programs, on sabbaticals and much else.

But here’s the thing. There are dozens of reasons for 180 billion unemployed labor hours, but whether the Fed is monetizing $80 billion of public debt per month or not, and whether the money market interest rate is 10 bps or 35 bps doesn’t even make the top 25 reasons for unutilized adult labor. What actually drives our current 43% unemployment rate is global economic forces of cheap labor and new productive capacity throughout the EM and dozens of domestic policy and cultural factors that influence the decision to work or not.

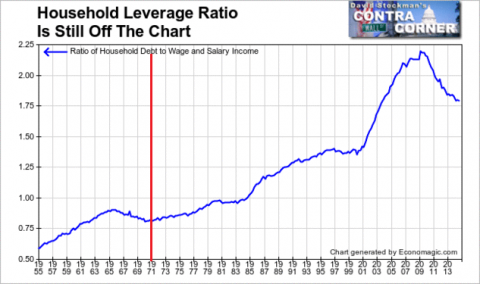

To be sure, for a brief historical interval—-from roughly the New Economics of the Kennedy Administration to the 2007 eve of the housing crash and financial crisis—- the Fed did levitate the GDP and meaningfully impact the labor utilization rate. That was owing to the one-time trick of levering up the household and business sector through the inducements of cheap debt.

But that monetary parlor trick is over and done. Household’s are still de-levering relative to income, and the Fed’s bubble economics have channeled incremental business borrowing almost entirely into the secondary market of financial engineering. That is, borrowings which are applied to stock buybacks, M&A deals and LBOs result in a re-pricing of existing equity claims and more gambling stakes in the casino, but do not add to demand for new plant, equipment and other tangible assets.

So the transmission channels through which monetary central planning could historically impact the labor utilization rate are now broken and done. The Fed’s default business, therefore, is inflating the financial bubble and subsidizing carry trade speculators. That’s all there is to monetary policy at the limits of peak debt.

In that context, consider the complete foolishness of school marm Yellen’s campaign to fill up the bathtub of potential GDP by causing labor utilization to reach full employment. And start with the case of non-monetized labor.

Back in the 1970s during one of those periodic debates about full-employment, legendary humorist Art Buchwald proposed a sure fire way to double the GDP and do it instantly. That was in the time that most women had not yet entered the labor force and politically incorrect discussion was still permitted on the august pages of the Washington Post.

Said Buchwald, “Pass a law requiring all men to hire their neighbor’s wife!” That is, monetize all of the cleaning, cooking, washing and scrubbing done every day in American households and get the monetary value computed in the GDP; and, in the process get homemakers factored into the labor force and their contribution to the economy’s real output in the labor utilization rate.

As a statistical matter—-even though four decades of women entering the labor force have passed since Buchwald’s tongue-in-cheek proposal—- there are still approximately 75 billion un-monetized household labor hours in the US economy. Were they to be counted in both sides of the equation, our 43% unemployment rate would drop to 25% for that reason alone.

Needless to say, whether household labor is monetized or not has no impact whatsoever on the real wealth and living standards of America, even if it does involve important social policy implications. The point is, as an economic matter Janet Yellen can’t do a damn thing about it, even as she dithers about asking Wall Street speculators to pay 35 bps for their overnight borrowings.

And the same thing is true for almost every single factor that drives the true hours based unemployment rate. Front and center is the massive explosion of student debt—now clocking in at $1.3 trillion compared to less than $300 billion only a decade ago. The point is not simply that this debt bomb is going to explode in the years ahead; the larger point is that for better or worse, Washington has made a policy choice to keep upwards of 20 million workers out of the labor force and to subsidize them as students.

Whether millions of these debt serfs will get any real earnings enhancing benefits out of this “education” is an open question—–one that leans heavily toward not likely in either this lifetime or the next. But these 40 billion potential labor hours are far greater in relative terms than under the stingy student subsidy programs which existed in 1970 when Janet Yellen was learning bathtub economics from James Tobin at Yale.

Likewise, there are currently about 17 billion annual potential labor hours accounted for by social security disability recipients. Again, that is a much larger relative number than a few decades back, and it is owing to the deliberate liberalization of social policy by Congressional legislators and administrative law judges. The FOMC has nothing to do with this form of unemployment, either.

Then there is the billions of potential labor hours in the un-monetized “underground” economy. While the work of drug runners and street level dealers is debatable as a social policy matter, it is self-evident that state policy—–in the form of the so-called “war on drugs” and the DEA and law enforcement dragnet—–account for this portion of unutilized labor, not the central bank.

The same is true of all the other state interventions that keep potential labor hours out of the monetized economy and the BLS surveys—-most especially the minimum wage laws and petty licensing of trades like beauticians, barbers, electricians and taxi-drivers, among countless others.

Finally, there is the giant question of the price of labor as opposed to the quantity. And here it needs be noted that “off-shoring” is not just about shoe factories and sheet and towel mills that went to China because American labor was too expensive. Owing to the rapid progress of communications technology, an increasing share of what used to be considered service work, such as call centers and financial back office activities, have already been off-shored on account of price. And that process of wage suppression has ricocheted into adjacent activities owing to the willingness of off-shored workers to accept lower wages in purely domestic sectors when push comes to shove.

Indeed, the cascade of the China “labor price” through the warp and woof of the entire economy is so pervasive and subtle that it cannot possibly be measured by the crude instruments deployed by the Census Bureau and BLS.

In short, Janet Yellen doesn’t have a clue as to whether we are at 30% or 20% unemployment of the potential adult labor hours in the US economy. But three things are quite certain.

First, the real unemployment rate is not 5.5%—–the U-3 number is an absolute and utterly obsolete joke.

Secondly, the actual deployment rate of America’s 420 billion potential labor hours is overwhelmingly a function of domestic social policy and global labor markets, not the rate of money market interest.

And finally, the Fed is powerless to do anything about the real labor utilization rate, anyway. The only tub its lunatic money printing policies are filling is that of the Wall Street speculators.

And that’s what the Warren Buffett economy is actually all about.

In Part 5, the possibility that the free market in finance could function just fine without activist monetary policy intervention and bubble finance fortunes like Warren Buffett’s $73 billion will be further explored.

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.