Lies, Damned Lies And Government Statistics

SPECIAL

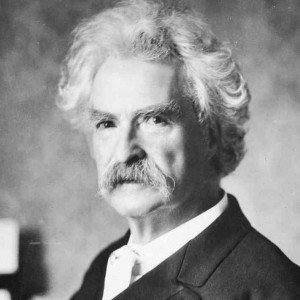

Mark Twain said, "There are three kinds of lies: lies, damned lies and statistics.”

“There are three kinds of lies: lies, damned lies and statistics.” — Mark Twain

With all due respect to Twain, he did not extend the thought far enough; government statistics trump all lies. But then again, the government’s role as both pre-eminent statistics gatherer and manipulator is a phenomenon more applicable to our time. Today, various U.S. bureaus and agencies monkey with every key macroeconomic indicator: most notably, inflation, production (gross domestic product) and unemployment.

Inflation

Since the early 1980s, the Bureau of Labor Statistics (BLS) has engineered a lower “inflation” rate in the consumer price index (CPI) with such maneuvers as:

- Accounting for “quality” improvements in goods (“hedonic adjustments”),

- Replacing items in the basket of goods measured with lower-price items (“substitution”),

- Decreasing the impact of rising prices by any particular good within the basket (“geometric weighting”),

- And changing how rents are measured (“imputation”).

The results? According to ShadowStats, which calculates inflation with the previous CPI methodology, inflation has been understated by 5 to 6 percentage points over recent years.

Gross Domestic Product

GDP, to the extent it is relevant at all, must be assessed in real terms (discounting the effects of inflation). Otherwise, how else could you discern economic growth from a mere rise in prices? Therefore, economists “deflate” GDP statistics by the rate of inflation to determine real changes in economic output. Curiously, instead of using the CPI in such calculations, the government uses a different price index, entitled personal consumption expenditures (PCE). Why? As the PCE index is chronically lower than the CPI, real economic growth appears higher than if the CPI were used. Not content with just this trick, the Bureau of Economic Analysis (there are a number of U.S. agencies which compile economic statistics) rolled out new guidelines for GDP calculation on July 31: Henceforth, expenses paid for research and development will be included to “capture” the benefits of intangible assets. GDP jumped 2.7 percent with the addition (every little bit helps), and future growth is projected to be higher with the change.

Unemployment

As of October, unemployment stood at 7.3 percent. Notwithstanding the previous month’s rate of 7.2 percent, this represented its lowest level since December 2008 (7.3 percent), which appears an impressive rebound given its peak of 10 percent (October 2009). But the labor force participation rate, the statistic that measures the actively employed percentage of an economy’s workforce, stands at a mere 62.8 percent (October) — a level not observed since 1978. The discrepancy? Literally millions of discouraged unemployed workers having ceased looking for work. In BLS calculations, if you do not have a job, you are unemployed. If you have been looking for years and have become so disillusioned as to end your efforts, you are no longer unemployed — but you still do not have a job.

We understand that many areas of the economy cannot be measured with any precision. In fact, the Austrian school of economics, to which we subscribe, was the first to point out the difficulties of measuring something as seemingly innocuous as the price level.

Because of such difficulties, it is reasonable to believe economists seek to improve their accuracy and worth. But when do refinement and improvement become, not a purpose, but a pretense for goosing the numbers? The aforementioned machinations prove we are already there.

However, worse than the manipulation of statistics to placate the populace and the financial markets is the reason the government is so interested in statistics. In his book Statistics: Achilles’ Heel of Government, noted economist Murray Rothbard explained:

Statistics are the eyes and ears of the bureaucrat, the politician, the socialistic reformer. Only by statistics can they know, or at least have any idea about, what is going on in the economy. Only by statistics can they find out . . . who “needs” what throughout the economy, and how much federal money should be channeled in what directions.

Statistics are the critical tools of the central planners. Their growth in usage tracks the retrenchment of free markets from the economic landscape. Their manipulation reflects the deterioration of an economy.

Twain may have been a great author of fiction, but the U.S. government wins the Pulitzer.

–Christopher P. Casey

Christopher P. Casey, CFA®, CPA is a Managing Director at WindRock Wealth Management (www.windrockwealth.com)

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.