Unhappy New Year: The U.S. Economy Is Stalling Out

A big point is being lost in buzz of the holidays, end-of-year excitement and the market’s hubbub over the start of the first Federal Reserve policy tightening campaign in more than a decade: America's economy is stalling.

If the trend continues, stocks could weaken as the calendar flips into 2016.

Just look at the recent data.

The Dallas Fed’s Manufacturing Activity index dropped to its lowest reading since May, dragged down by a decline in new orders. Ongoing weakness in manufacturing underscored a 0.4 percent drop in core capital goods orders in November. Core capital shipments were down 0.5 percent. This was well below expectations and led Capital Economics to reiterate their Q4 GDP growth estimate of just 2.0 percent.

Last week, the National Association of Realtors showed existing home sales coming in at a seasonally adjusted annual rate of 4.76 million in November, a 10.5 percent drop from October and below the 5.40 million consensus estimate. This was the weakest result in 19 months. The NAR blamed the result on sparse inventory and affordability issues resulting from higher prices.

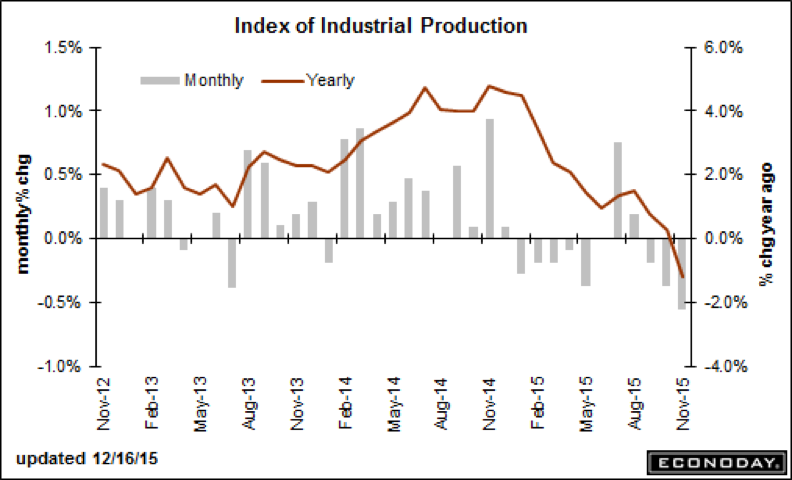

The week before, we learned that U.S. industrial production dropped 0.6 percent in November, a month-over-month decline not seen in three-and-a-half years. While mild weather is playing a role, lessening the demand on utilities, readings were soft overall, reflecting a slowdown in global demand for U.S. products as a result of the dollar's recent strength.

It's likely that financial markets will grow increasingly concerned about the Fed's more aggressive rate hike forecast for 2016, which calls for four 0.25 percent hikes, while futures are pricing in between two and three hikes. A faster rate of Fed tightening could very well result in further economic weakness at a time of vulnerability.

This is the message of the Atlanta Fed's GDPNow real-time tracking estimate of Q4 GDP growth, which has fallen to a low of 1.3 percent as consumer spending is expected to be less robust this holiday shopping season (their "nowcast" for Q4 real consumer spending growth fell from 2.6 percent to 2.1 percent).

The result of the loss of momentum has been a fresh decline in the Citigroup Economic Surprise Index, which tracks where the economic data come in relative to expectations. When the data is better than analysts are estimating, the line rises. When it's weaker, the line falls.

As you can see, the index (in yellow) has returned to early 2015/late 2014 lows that were, at the time, caused by severe winter weather. Stocks have historically underperformed when this happens — but the relationship has been more or less broken since the Fed launched the QE3 bond-buying stimulus in 2012.

With interest rates moving higher for the first time since 2006, will 2016 be the year the weak stocks/weak economy relationship is restored? We're about to find out.

Technically, stocks are on the precipice, with the Dow Jones Industrial Average falling back below its 50-day and 200-day moving averages. The stochastic indicator, a measure of momentum strength in the lower pane of the chart below, has flashed a sell signal.

Don't expect much movement until a few days into 2016, when recent concerns about low commodity prices, stalled corporate earnings growth, rising interest rates, troubles in China and weak economic data eclipse the seasonal strength of the "Santa Claus" tailwinds stocks enjoy this time of year.

No comments:

Post a Comment

Thanks for commenting. Your comments are needed for helping to improve the discussion.