Our goal is to have intelligent discussion of the topics of the day. We realize everyone has their opinion and they should be allowed to express it in a discussion forum without calling each other names. We learn from discussion and not from name calling or argument.We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners. See details

Contact Form

Wednesday, December 31, 2014

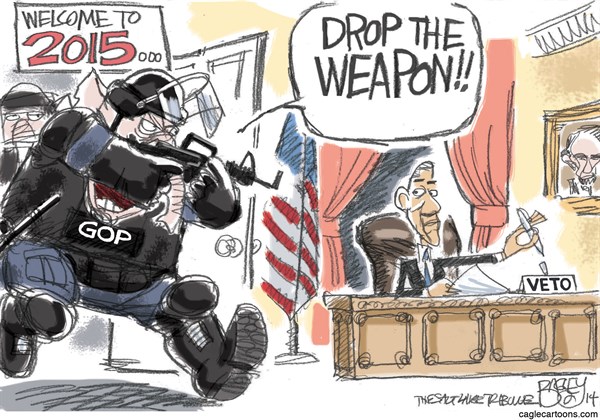

Israel Finds Support In Congress

Lindsey Graham assures Netanyahu that Congress works for Israel

Sen. Lindsey Graham (R-S.C.) promised that the U.S. Congress will be at the beck and call of Israel’s leadership with regard to Iran in remarks he made alongside Israeli Prime Minister Benjamin Netanyahu during a visit to the Middle Eastern country over the weekend.

“No. 1: I wanted to come here in the most desperate way before the new Congress reconvenes, to let you and the people of Israel know that the United States Congress, above all entities in America, has your back in a very bipartisan way,” Graham said.

“The Republican Party now runs the House and the Senate, and things will be a bit different,” the GOP lawmaker said before vowing that the U.S. will take action against Iran.

Graham noted that the Senate is scheduled to vote on legislation that would strengthen sanctions against Iran if the country violates an interim nuclear agreement or walks away from talks soon after Congress reconvenes in January. The legislation was drafted by Senate Foreign Relations Chairman Bob Menendez (D-N.J.) and Sen. Mark Kirk (R-Ill.).

“Mr. Prime Minister, of all the leaders in the entire world, you’ve had the most consistent message regarding Iran: Beware of the Iranians — they lie, they cheat. To those who believe the Iranians have not been trying to develop a nuclear weapon, if you come to America, you should not be allowed to drive on our highways. Clearly, this regime for years has been deceiving the international community, has been trying to pursuit, in my view, a nuclear weapon,” Graham said to Netanyahu.

The GOP lawmaker went on to say that he believes heightened sanctions are a better course of action than the diplomatic solutions being explored by the Obama administration.

“I’m here to tell you, Mr. Prime Minister, that the Congress will follow your lead,” Graham said.

In the coming months, Graham said, Congress will impose sanctions that “are real and will be re-imposed at the drop of a hat.”

“The fate of one country determines the fate of the other,” the lawmaker said.

While Graham’s remarks were certainly crafted to endear him to the Israelis and war hawks at home, he has drawn criticism from others who believe the U.S. could work with Iran in other ways.

One writer for former Congressman Ron Paul’s Institute for Peace and Prosperity wrote of Graham’s speech: “Imagine the reaction if a sitting United States Senator travelled to France, or Russia, or Saudi Arabia and assured the foreign leader that the U.S. lawmaking body would ‘follow your lead’ when it comes to a decision on whether ‘more sanctions, and stronger sanctions’ should be placed on a third country. That a U.S. government official would openly subject his own country’s policies to the national interest of another country seems to be unpatriotic by definition.”

Think You Can Move Your Money Out Of The US In Case Of A Disaster, Think Again. FATCA Will Severely Hamper That Move

|

URL and to post comments: http://dollarvigilante.com/blog/2014/12/30/the-latest-fatca-propaganda-atrocities.html

Tuesday,December 30, 2014

[The following post is written by Director of TDV Offshore, Paul Seymour]

It’s been a while since the whole FATCA charade has annoyed me enough to spend more time writing about it, but recently, a series of events have finally caused me to return to this sordid subject.

First, about a month ago, An article titled Offshore Voluntary Disclosures: To Certify or Not to Certify popped up, making some more outrageous statements, and starting with the usual threats—“Taxpayers with undisclosed foreign assets face an even greater risk of detection than ever before”. Obviously trying to lend further credence to the US government propaganda campaign that all US citizens who prudently shift assets from behind the curtain in order to evade illegal IRS/FBI/DHS/ICE/DEA confiscation without due process, and get out of the soon-to-nosedive dollar, must be criminals trying to evade taxes.

IRS CREDIBILITY?

We’re informed that the new IRS 2014 Offshore Voluntary Disclosure Program is now underway, and is designed for those who have failed to “submit required information returns due to willful conduct and who seek assurances that they will not be subject to criminal liability and/or substantial monetary penalties”. Hilarious, actually, considering the past egregious lies told by this law-breaking and unaccountable body, which can’t really expect to hold any credibility with anyone in the world, at this point. We all know they will consider as “willful evaders” people who have lived overseas for 20+ years, and who rightfully never dreamed they had any responsibility to tell a foreign government anything whatsoever about their assets. Why would any reasonable person think they would?

So, just to show you that the IRS are reasonable guys, the new program will only inflict a “50 percent miscellaneous offshore penalty, instead of the 27.5 percent penalty” under the old program. I’ll stress again, that the real game here isn’t to collect taxes due, because the vast majority of the people being hounded by the IRS don’t owe any taxes. The real boon for them, is that they have the ”legal” right to take 50% of your offshore financial assets, merely for not telling Treasury and the IRS that they existed. As one poor old fellow in Florida discovered earlier this year, that could be construed to mean 50% of your offshore balance for each year unreported.

In June, 2014 Mr. Carl R. Zwerner, of Miami, was found guilty of the heinous crime of not telling the US government that he had money in an offshore, and therefore safer bank. Not that he owed any taxes related to that money, mind you, but only that he failed to inform the Fatherland that he had it. It was a little over USD $1.5 million. That will keep an 87 year old guy alive in a decent manner nowadays in Miami, but isn’t exactly a fortune in today’s economy. Displaying the type of blatant tyranny which now exists in the former America, he was then fined 50% of his total balance for each of the 3 years he was accused of not telling Uncle Sam he had it. According to Forbes, “that meant FBAR penalties of $2,241,809 for an account worth$1,691,054”. I’ll stress again, no one showed that he owed a single thin dime in taxes, he just didn’t tell anyone he had some of his hard earned money wherever he chose to place it.

In Mr. Zerner’s case, according to Forbes Magazine “he tried to come forward in 2009 even before the IRS had a special program. You’d think that might immunize him, but it didn’t. He had his tax counsel in 2008 contact IRS Criminal Investigation and make a voluntary disclosure. Mr. Zwerner disclosed the existence of his offshore account (including income generated by the account) on his timely filed 2007 tax return and paid the taxes. His former tax lawyer asked the IRS anonymously, so in IRS parlance, Mr. Zwerner didn’t fully come forward. Still, he did file amended returns for 2004, 2005 and 2006 and FBARs. But in 2010, the IRS began an audit.” Therefore, he had actually even paid the taxes due before the IRS began an audit. Furthermore, “willfulness can include conscious efforts to avoid learning about the FBAR reporting. It is sometimes called willful blindness.”

What does that even mean? How would one go about proving that someone consciously avoided learning something? Myself, when I was lucky enough to get the hell out, I learned that applying basic common sense is sufficient beyond the iron curtain, and in common sense terms, I obviously owed no money to the place where Iused to live. Is that willful blindness?

The author of the Offshore Voluntary Disclosures: To Certify or Not to Certify article is an attorney who represents many taxpayers in audits and collection matters before the Internal Revenue Service. In her experienced opinion “Although the IRS has articulated a standard of willfulness that seems to be in line with the one generally applied by the courts, it is unclear whether the IRS will remain faithful to that standard.”

So basically, you’ll be proven a willful evader, one way or another. I’ll just leave you to ponder all of that, and form your own conclusions about IRS credibility.

MORE IRS MISDIRECTION ON FATCA

Two weeks ago the following was posted IRS Extends ‘Deemed Compliant’ Status of Countries for FATCA.

“The Internal Revenue Service has issued an announcement extending the “deemed compliant” status of the 19 countries that are treated as if they had an intergovernmental agreement with the U.S. Treasury Department in place for purposes of the Foreign Account Tax Compliance Act.”

That could be interpreted as desperation by some. The fact is, that many of these 19 IGA’s have not yet been signed, and are merely “agreements in substance”. Even more relevant is that even if 19 countries had signed an IGA, which they haven’t, then 176 countries have not. I’ll mention yet again, that Treasury has no legal authority to go around the world negotiating such treaties, and none of them have been ratified by Congress. Also relevant is that recently, Senators Mike Lee and Robert Portman have joined Rand Paul and Bill Posey in the fight to repeal FATCA, and are on a tour of Europe waging war against it. The Canadian and Swiss people are actively working to demand that their elected representatives overturn two of those 19 hopeful IGA’s the IRS is banking on as well.

It’s glaringly obvious that Congress would never ratify the IGA’s because most of them, like the one with Germany for example, require that the US assure reciprocity. In other words, every US financial institution would then be obliged to report to every foreign government of those 195 countries regarding accounts held in US financial institutions by their citizens. In other words, incur billions in compliance costs. It is highly unlikely that Congress would never do that, and have essentially said they would not. Therefore, the whopping 19 IGA’s in place, at least in substance, are meaningless, at least from a legal perspective. They are certainly meaningless from a Constitutional perspective, but I realize that Amerika no longer has a Constitution in place.

Furthermore, I’ll repeat yet again, that if just a handful of those 195 nations holds out, in defense of their own national sovereignty, like Russia and China, for example, FATCA will be effectively unenforceable. Can you imagine Treasury withholding 30% from just a portion of the 10,500 banks who currently use the SWIFT system? That is why it isn’t currently being enforced as we speak. It remains, merely, a threat. Try to imagine the capital flight which would occur if there were such a clear dividing line. Money would flock in huge numbers to the privacy-respecting jurisdictions.

I’ve already stated that FATCA is just one more nail in the coffin of the USD as world reserve currency, and that’s looking to be true. The final nail may have been the threat of kicking Russia out of the SWIFT system. This has virtually assured that the superpower, along with China, will develop their own version of SWIFT, and completely outside the USD. In fact, that is already stated as an objective by Q1 of 2015. The BRICS nations have already set wheels in motion to establish an alternative to the IMF after a summit held in Brazil, where I’ll be heading next in order to set-up banking relationships outside of the US banking system.

Establishing a system outside of SWIFT will be a huge challenge, but under such pressures, I wouldn’t bet the Russians and Chinese couldn’t pull it off. BRICS account for 20% or so of international GDP, and have a few banks of their own. I think if Putin and Xi Jinping suggested that banks in Russia and China start using a system other than SWIFT, and stop dealing in USD, they might get heard by a few. Couple that with the gold accumulation of those two countries lately, and the refusal of the Fed to be audited and prove their gold inventory. You might be aware that South Africa and India have a bit of gold of their own, too. We’ll see how it plays out. It’s getting interesting, to be sure.

The article states “Last week, the IRS and Treasury extended that time period. Announcement 2014-38 provides guidance with respect to jurisdictions that are treated as if they had a FATCA intergovernmental agreement in effect, but that do not sign an IGA before Dec. 31, 2014.”

Hopefully most can clearly see that Treasury is getting slow-rolled to death here. The writing is on the wall, and they’d love to save face. Uncle Sam looks like an exhausted boxer throwing a couple of last feeble punches before catching the coup de grace on his white bearded chin.

BANKS REQUIRING NON US-CITIZENS TO COMPLETE US TAX FORMS

Finally for me was learning that unfortunately, for those of us who demand our basic human right to personal privacy, and the application of due process of law, even the banks in offshore jurisdictions are showing a complete lack of fortitude in the preservation of their sovereign status. In the last half of this year, I know of cases where a Bulgarian citizen was forced to complete a form swearing he was not a US citizen in order to open an account at HSBC in Hong Kong. Not that surprising considering HSBC’s status as an IRS subsidiary after the non-prosecute agreement over “terrorism” and “money-laundering.”

What did really surprise me was a small private bank, in a heretofore privacy and due-process-respecting jurisdiction, requiring that a Canadian citizen complete a form swearing that they were not a US citizen “in order to comply with FATCA”. I should think that the respective Bulgarian and Canadian passports, in addition to the related proof of address would have been sufficient. I mean, could you imagine a US citizen being required to prove that he wasn’t Canadian just so that he could open a bank account in the US?

In defense of the bank, I’m also aware of at least two offshore banks which have held strictly to their privacy policies, and in accordance to the laws of the nations in which they’re domiciled, and have suffered life-threatening attacks in retaliation for such principled behavior.

Both Loyal Bank in St Vincent, and now BMI Offshore in Seychelles, were suddenly informed by intermediary banks that they could no longer perform transfers in neither USD nor Euros. This was done by the intermediary banks without any stated justification, but I also know that some US bureaucrat was able to throw out that old smear “suspected of money laundering”. Obviously without any due process, nor proof of any kind being provided. I think we can see what’s going here, though. Uncle Sam no longer has time for due process in his desperate final throes.

However, I’d really like to know who sat down, and decided that from now on, all non-US citizens will be required to file a form, based on US laws, in order to open a bank account. That should frighten everyone who cares at all about personal freedom.

Things are happening fast campers. We’re working here to change as rapidly as are the times. That includes looking hard at BRICS jurisdictions for potential bank accounts in the near future. It also includes a unique vehicle which allows higher net worth people from the US a way to move money offshore and maintain their basic human right to personal privacy and not be subject to FATCA.

During my stay here in Uruguay, it was reported that Uruguay and Brazil will now settle all trades in local currencies, and get substantially out of the USD. Said the Brazilian President—“The measure is a step forward in Latin American monetary independence, and the best opportunity for the countries of South America to get rid of the old mechanisms of economic regulations dictated by the United States." Also during my stay, I’ve gained the ability to efficiently establish Uruguayan entities for the benefit of our clients (the best solution for those who need a merchant account for an online business), and I’ll soon be doing the same regarding bank accounts in Brazil. I’m also in preliminary talks with a Russian acquaintance to offer accounts in Russia, should the changing times make that a wise move (the Ruble, by the way, has nearly completely recovered from its recent flash crash - something mainstream media has ignored).

I truly wish that the country which the families Seymour and Greene came to in the 1630’s hadn’t turned out this way, but it’s what we’ve got. They were fleeing the upcoming English Civil War which broke out in 1642, and it may well be our time to adapt or die.

“True patriots love their country all the time, and their government when it deserves it” – Mark Twain

[Editor's Note: For more information on FATCA, contact TDV Offshore today]

|

Labels:

BMI Offshore,

Brazil,

canada,

conservative blogs,

conservative musings,

Conservative Tom,

FATCA,

foreign bank accounts,

HSBC,

IRS,

Offshore Voluntary Disclosure,

Seychelles,

Uruguay

Israel Wins Against Palestinian Statehood Bid, This Time. However, France And Luxembourg Voted For It. How Long Will US Stand With Israel?

In Stinging Defeat, UN Rejects Palestinian Bid for Statehood

By Lea Speyer

“Light dawns in the darkness for the upright; he is gracious, merciful, and righteous.” (Psalm 112:4)

The Palestinian draft resolution was rejected by the UN Security Council on December 30, 2014 in a stinging defeat. (Photo: Issam Rimawi/Flash90)

The UN Security Council rejected on Tuesday the Palestinian draft resolution calling for the full Israeli withdrawal from East Jerusalem, Judea and Samaria by the end of 2017.

The resolution, which was submitted on Monday by Jordan on behalf of the Palestinian Authority, called for peace negotiations to center around creating a Palestinian state on pre-1967 borders. It also called for a permanent peace agreement within 12 months.

The resolution failed to receive the nine vote minimum by the Security Council. Out of a total of 15 members, eight votes were in favor, two against and five abstentions.

The United States and Australia voted against the measure. Among European nations, France and Luxembourg voted in favor while Britain and Lithuania abstained. Among African nations, Chad voted yes while Rwanda and Nigeria abstained.

France’s vote in favor of the resolution surprised Israel. Hours before the vote, the Israel’s Foreign Ministry was informed that Paris had changed its position and intended to vote yes on what they called a “softer” statehood resolution.

Had the draft received the nine vote minimum, it would have been defeated by a veto from the United States, one of the five veto-wielding permanent members of the Security Council.

US Ambassador to the UN Samantha Power defended her country’s position on voting against the resolution, making clear that it was not a vote against peace between Israel and the Palestinians.

“The United States every day searches for new ways to take constructive steps to support the parties in making progress toward achieving a negotiated settlement,” she said in a speech to the 15-member council. “The Security Council resolution put before us today is not one of those constructive steps.”

“It is deeply imbalanced and contains many elements that are not conducive to negotiations between the parties, including unconstructive deadlines that take no account of Israel’s legitimate security concerns,” Power said, adding that the resolution “was put to a vote without a discussion or due consideration among council members.”

Jordanian Ambassador Dina Kawar expressed her frustration that the resolution was defeated.

“We had hope that the Security Council will adopt today the draft Arab resolution because the council bears both the legal and moral responsibilities to resolve the Israeli-Palestinian conflict,” she said.

Palestinian observer to the UN Riyad Mansour blamed the defeat of the resolution on the result of the recent war between Israel and Hamas. He said it was time to end the “abhorrent Israeli occupation and impunity that has brought our people so much suffering.”

“The result of today’s vote shows that the Security Council as a whole is clearly not ready and willing to shoulder its responsibilities in a way that would…allow us to open the doors to peace,” he stated. “It is thus most regrettable that the Security Council remains paralyzed.”

In a brief statement to the Security Council, Israeli delegate Israel Nitzan said that the Palestinians have used every possible means to avoid direct negotiations and this resulted in a “preposterous unilateral proposal.”

“I have news for the Palestinians – you cannot agitate and provoke your way to a state,” he said.

LISTEN BELOW: Special Report: Resolution for Palestinian State Fails in UN Security Council

Read more at http://www.breakingisraelnews.com/26729/in-stinging-defeat-un-rejects-palestinian-bid-for-statehood-jerusalem/#EtskPuCJmIUtWBY3.99

Police Murders Will Only Stop Once Black Leadership And The White House Demand It. Until Then It Is War On Cops!

Another Police Officer, Father of Six, Shot and Killed Overnight – Team Obama Strikes Again

Another police officer was murdered while on duty, only a day after two New York City Officers were ambushed and massacred while they sat helplessly inside their patrol car.

A Tarpon Springs Police Department Officer, 45-year-old Charles Kondek, who was originally from New York and had previously served on the NYPD for five years, was the latest victim of the civil unrest that the executive branch has sown and the open season on law enforcement that it has declared. Kondek had served the Tarpon Springs community for 17 years.

The Pinellas County Sheriff’s Office issued a statement that the suspect is in custody. They identified him as 23-year-old Marco Antonio Parilla Jr. No indication as to his legal status within the United States was provided.

Officer Kondek was dispatched to a call shortly after 2 am. The suspect shot Officer Kondek and then fled the scene, subsequently crashing his vehicle into a pole and then another vehicle in his attempt to escape. He was arrested at the scene of the accident.

The Tampa Bay Times reported that Officer Kondek was a father to six children.

Read more at http://universalfreepress.com/watch-another-police-officer-father-of-six-shot-and-killed-overnight-team-obama-strikes-again/

Subscribe to:

Comments (Atom)